Features and reports relating to the lease accounting standard IFRS 16 will only appear in organisations that have their Accounting and Finance Settings turned on. In this article, we'll guide you through each of the fields that contribute to your IFRS 16 reporting set up.

These fields would have likely been filled in by our Onboarding team when your company joined Nomos One as a customer. It is highly unlikely that you would need to alter the recorded information after this initial set up, but you are able to do so if necessary. If you are wanting to update this information and have any questions about the fields on this page, we recommend that you reach out to our Support Team (support@nomosone.com) to discuss any potential implications upon your financial reporting balances.

How to access the Accounting & Finance Settings

You can access the Organisation's Accounting and Finance settings by navigating to the Settings page, and selecting the Accounting & Finance tab on the left panel.

Please note: Only Admin users are able to access and make changes to an Organisation's Accounting and Finance settings.

General Settings

Under General Settings you'll find information about the transition date of your Organisation and currency used for reporting.

The first field relates to your transition date, determining when IFRS 16 reporting applied to your portfolio. The day and month in this field work in with the Transition Date (year) field further down the page, to generate your transition date.

You will see a currency selected for the Functional Currency field, however, this is a legacy feature. The IFRS 16 reports will include the monetary amounts recorded on each individual Agreement, as per the currency selected on the Rent & Payment page, rather than converting those values into one singular currency. You are able to view relevant currency information in the IFRS 16 reports, either by default or by adding columns to view the currency for each Agreement.

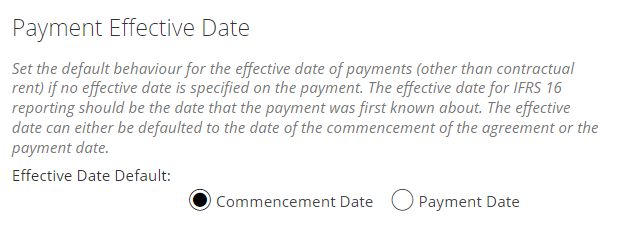

Payment Effective Date

The Payment Effective Date feature is exclusively for users who had completed onboarding of their portfolio prior to the 1 July 2020 Effective Date software upgrade. If this is you, and you'd like guidance on how this feature works, please reach out to our Support Team.

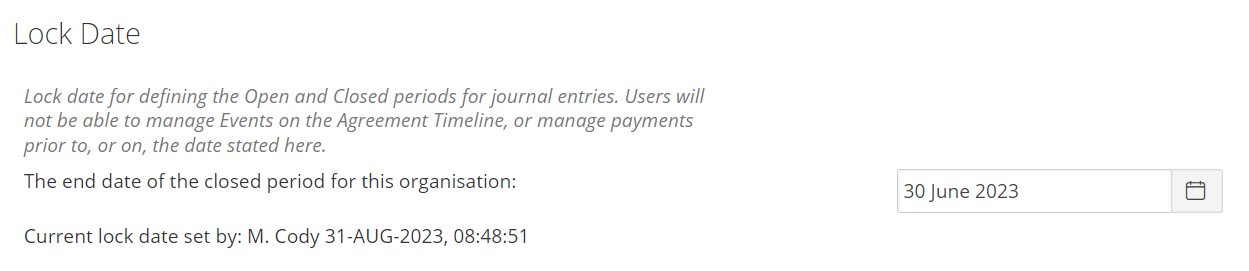

Lock Date

If you'd like to set a Lock Date, enter the end date of the locked period for this organisation. You can also see who last set the Lock Date here. We'd recommend checking out our article for more information on the Lock Date in Nomos One.

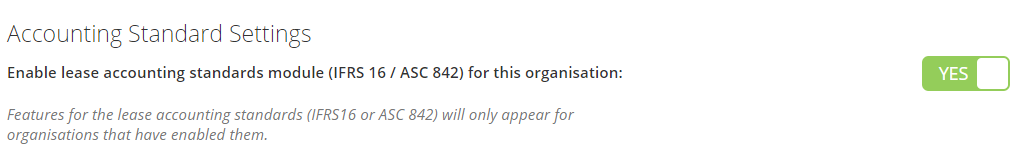

Accounting Standard Settings

To see the accounting standards features and reporting in your organisation, the lease accounting standard module needs to be enabled. This is done by toggling the bar to read Yes:

IFRS 16 will be selected under Accounting Standard:

Please note: Nomos One does not currently support US GAAP.

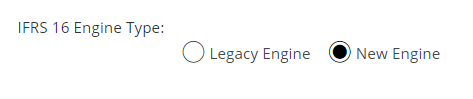

The New Engine option will be selected under the Engine Type:

The Legacy Engine is available - for comparison purposes only - to customers who completed the onboarding process prior to the 1 July, 2020 New Engine release. All customers who joined after this release should remain using the New Engine to power their calculations, and will not see this field included on this page. All future upgrades and developments will only be implemented on the New Engine.

Transition Settings

Under Transition Settings, you'll find your Organisation's transition year and the default transition method that applies to all Agreements you create.

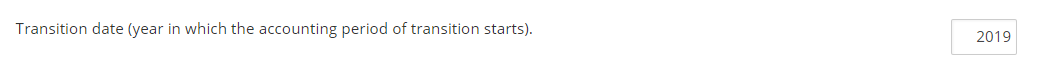

Your Organisation's Transition Year can be found in the Transition Date (year) field. Recall that this works in with the day and month recorded in the first field on this page to generate your transition date.

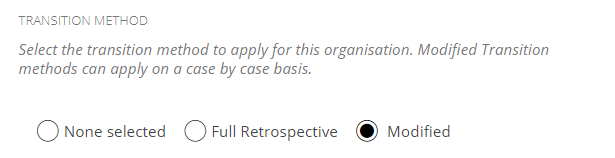

Your Organisation's Transition Method can be found here. The two main options, as per the reporting standard, are:

- Full Retrospective

- Modified Retrospective

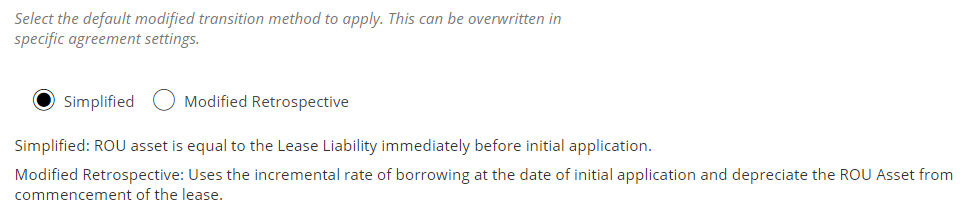

If you've adopted a Modified Retrospective transition, you can adopt either the Simplified (Option B) or Modified Retrospective (Option A) approach. We have given these options names in Nomos One to make it easier to distinguish between them.

For more information about the differing transition methods, check out this article.

Current and Non-Current Liability Calculation Method

When it comes to your disclosure requirements, there are two different methodologies that are available to companies when reporting on the Current and Non-Current Lease Liability:

- Lease Liability Movement

- Net Present Value

Check out this article for more information on these options.

Asset Classes

You can set up Asset Classes in your organisation, allowing you to filter and see your Disclosure report broken down by Asset, e.g., Property, Vehicles, Printers. These are optional fields, meaning that you do not need to set up Asset Classes if they are not necessary for your reporting purposes.

To create an Asset Class in your organisation, from the Asset Class Settings section:

- Click Add new.

- In the Description field, record the name of the Asset Class.

- Click Add to save.

Once you've created an Asset Class, you'll then be able to assign it to an Agreement for reporting purposes.

What's Next?

Once this page has been completed, the functionality for setting up the IFRS 16 judgments for individual Agreements will appear. The IFRS 16 reports will also become functional, however these will not produce any output until at least one Agreement is set up with IFRS 16 judgments.

Please note: GL Code Creator and Portfolio Expedient Settings Templates are legacy features, and will not produce any output if used. You should always skip past these features.

Nomos One does not provide or purport to provide any accounting, financial, tax, legal or any professional advice, nor does Nomos One purport to offer a financial product or service. Nomos One is not responsible or liable for any claim, loss, damage, costs or expenses resulting from your use of or reliance on these resource materials. It is your responsibility to obtain accounting, financial, legal and taxation advice to ensure your use of the Nomos One system meets your individual requirements.