If you need to change your IFRS 16 assumptions from when you recorded them in the initial IFRS 16 Questionnaire at the Commencement of an Agreement, you can use the IFRS Settings Changes Questionnaire.

This will update the assumptions effective from the date you add the change for. Any changes in the scope of a lease, the consideration given, the length of the term, or interest rate needs to be captured, and will result in a reassessment under the standard.

Where to find the IFRS Settings Changes Questionnaire

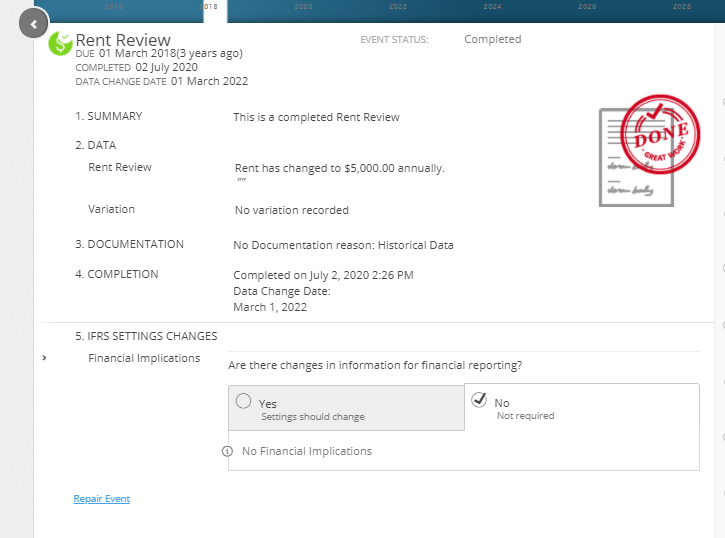

As we want to pinpoint the date that you're updating your IFRS settings, the IFRS 16 Settings Change Questionnaire is integrated into the Event completion process. Once an Event is completed on the Agreement Timeline, the Questionnaire will appear as the 5th step on the Event completion process.

If you're updating your assumptions in line with a scheduled event already on the timeline, you can answer the questionnaire on that Event. If you're updating your assumptions on a date where there is not already an event, you can add in a Variation Event and complete this to reveal the questionnaire.

As the IFRS 16 Settings Change Questionnaire is always tied to an Event, you won't be able to add or edit the IFRS 16 Settings Change Questionnaire on an Event that is within a locked period. You'll need to ask a user with the Administrator permission in your Organisation to edit the Lock Date. Check out this article for more information.

Breaking down the IFRS Settings Changes Questionnaire

The IFRS 16 Settings Change Questionnaire is a series of Yes/No questions and text fields. Beside each question there's a help button where you can find additional in-application guidance for each of the questions. You'll also see a comment box where you can capture any notes/justifications for the options you've selected or recorded.

The IFRS 16 Settings Change Questionnaire is undergoing review by our Development Team. As we've built a new engine and implemented new architecture throughout the application, some of the current questions are no longer needed, and others are no longer supported.

Once you've made your change, don't forget to scroll to the bottom of the Questionnaire and click Save to ensure the changes are saved correctly!

Subsequent measurement of Lease Liability Settings

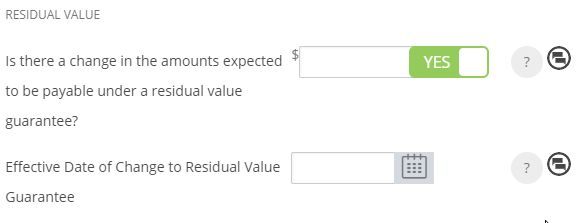

| Is there a change in the amounts expected to be payable under a residual value guarantee? |

If there is a change in the amount you're expecting to be payable under a residual value guarantee, you can capture this by toggling the bar to Yes, and recording the new residual value guarantee amount.

Use the text field or calendar tool to record the Effective Date of the change to your residual value guarantee.

|

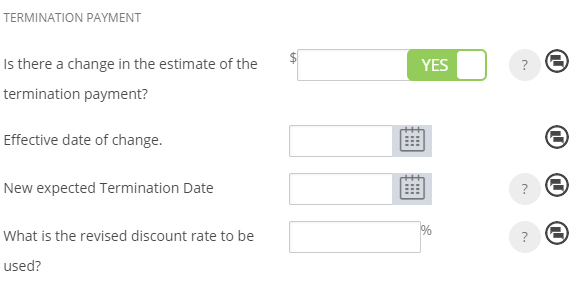

| Is there a change in the estimate of the termination payment? |

If you need to add or change your estimate of a Termination Payment or the expected Termination Date of your agreement, toggle the first question to Yes to reveal a series of additional questions.

If there is a change in the estimate of a Termination Payment, record the amount of this payment and use the text field or calendar tool to record the Effective Date of this change.

If there is a new expected Termination Date, you can capture this by using the text field or calendar tool to record the new expected Termination Date, and recording the effective date of this change. The new expected Termination Date must be after the Commencement of your Agreement but before the Expiry.

If you're updating the expected Termination Date but there is no change to the Termination Payment estimate, you can leave that field blank. If you need to record a revised Discount Rate, record this value and the Effective Date of change.

|

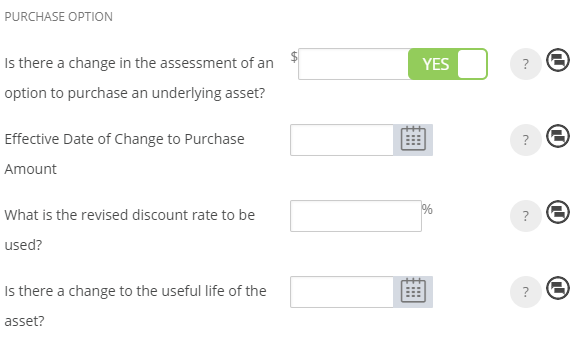

| Is there a change in the assessment of an option to purchase an underlying asset? |

If there is a change to your assessment of an option to purchase an underlying asset, toggle the question to Yes and record the amount.

Use the text field or calendar tool record the Effective Date of change.

If there is a revision of the Discount Rate to be used, you can also record that here.

If you need to change or update the useful life of the Asset, use the text field or calendar tool to record this date. Nomos One will only calculate your Lease Liability up to the end date of the Useful Life of the Asset as opposed to the life of your Lease.

|

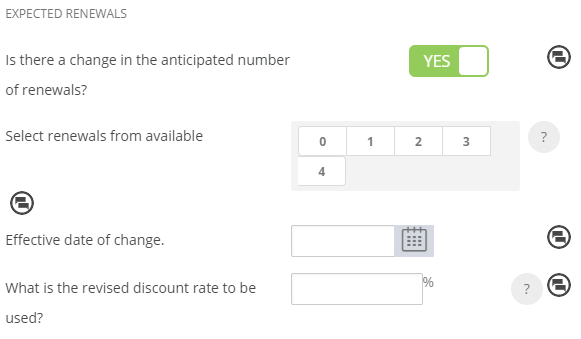

| Is there a change in the anticipated number of renewals? |

If there is a change to the anticipated number of renewals you'll exercise from what was entered in the initial IFRS 16 Questionnaire, you can capture this by toggling the bar to Yes and selecting the new anticipated number of renewals that you'll exercise from the available options.

Use the text field or calendar tool to record the Effective Date of this change. If needed, you can also capture a revised Discount Rate from the Effective Date of change.

|

| Other changes to lease liability (e.g. prepayment of lease payment)? | This functionality has not been re-platformed into the New Engine. As such, you cannot make any selections here.

|

Subsequent Measurement of the Right of Use Asset Settings

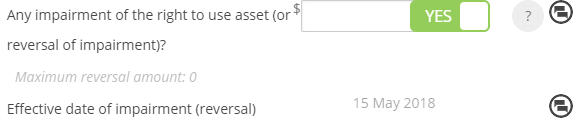

| Any impairment of the right to use asset (or reversal of impairment)? |

If any event under the IAS 36 standard results in the need to write down or write up the Right of Use Asset to reflect it's current carrying amount, you can record that amount in here.

To record an impairment to decrease the ROUA value, toggle the bar to Yes and record a negative number.

An impairment of the Right Of Use asset will occur when the lessee doesn't anticipate getting the full carrying value of the lease asset out of the lease. In essence, an impairment charge reduces the Right of Use Asset and the subsequent depreciation profile.

To record a reversal to increase the ROUA value, toggle the bar to Yes and record a positive number. The system will automatically use the Event Date as the Effective Date of your impairment.

|

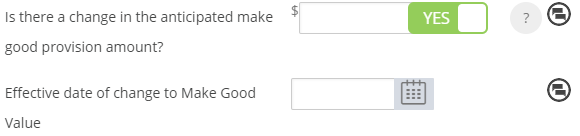

| Is there a change in the anticipated make good provision amount? |

To change or update the Make Good Provision amount, toggle the bar to Yes and enter the new amount.

Use the text field or calendar tool to record the Effective Date of change to your Make Good Value. Changes in this amount will have a flow on impact to the Right of Use Asset and the depreciation profile.

|

Revaluation of Right of Use Asset - IAS 40 & IAS 16

| Is there a Revaluation amount of ROU Asset in accordance with IAS 40 Investment Property? |

If you have revalued the Asset in accordance with IAS 40, the Asset or Lease does not depreciate, and so it will need to be revalued every year.

To record the revaluation of an asset, toggle the bar to Yes and record the revaluation of your investment property. Enter the Effective Date of the Revaluation.

|

| Is there a Revaluation amount of ROU Asset in accordance with IAS 16Property, Plant and Equipment? | This functionality has not been re-platformed into the new engine. As such, you cannot make any selections here. |

Subleased Elements

| Is the agreement subsequently subleased? | This functionality has not been re-platformed into the new engine. As such, you cannot make any selections here. |

Variation and Modification Accounting

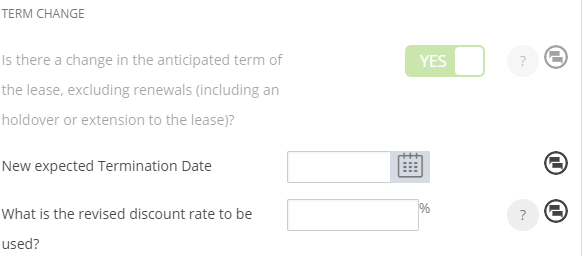

| Is there a change in the anticipated term of the lease, excluding renewals (including an holdover or extension to the lease)? |

This question should not be used. There are other methods for recording an increase in term length, or a decrease in lease term which produce correct journal entries.

If you need to update the Interest Rate applied to your Agreement, please use the Non-contractual Change in Rent question at the bottom of the questionnaire to do this.

|

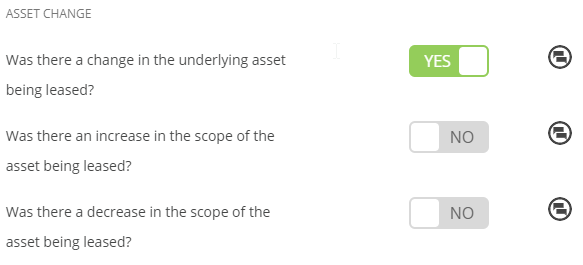

| Was there a change in the underlying asset being leased? |

If there are any changes to the underlying asset being leased, i.e. the lease has been varied to increase or decrease the scope of the asset you are leasing, toggle the bar to Yes. Once you have turned this on, you can specify whether there was an increase or decrease of the asset subject to the Agreement.

|

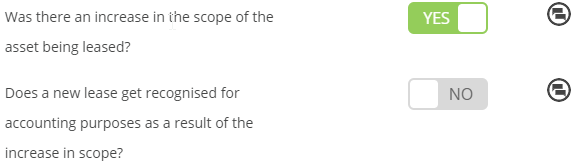

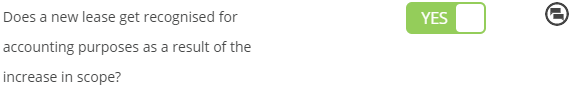

| Was there an increase in the scope of the asset being leased? |

If the asset being leased increases in scope, toggle the bar to Yes. In this scenario, the Right of Use Asset and Lease Liability will be remeasured, triggered by the change in discount rate and lease payments.

If a new lease is recognised for accounting purposes as a result of the increase in scope, toggle the bar to Yes. If the new asset is commensurate at a stand alone selling price, the modification will be accounted for separately.

|

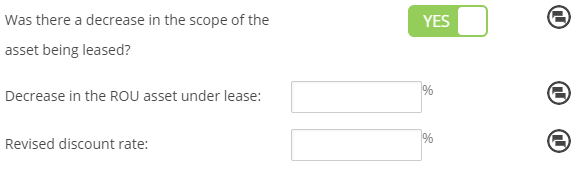

| Was there a decrease in the scope of the asset being leased? |

If there was a decrease in the scope of the asset being leased, a gain or loss must be calculated in relation to the Right of Use Asset.

To calculate the gain you must work out the percentage of decrease change. E.g. if you are reducing the premises area of the lease from 100 sqm to 50 sqm, this would be a 50% decrease. You can also record the revised Discount Rate if applicable.

|

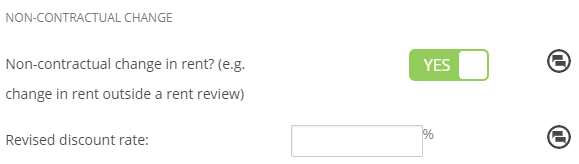

| Non-Contractual Change in Rent? (e.g. Change in Rent outside of a Rent Review) |

If there is a non-contractual change in Rent, or if you need to review the Discount Rate of your agreement, you can toggle this question to Yes and record it here.

|

Once you've updated your assumptions, remember to click Save at the bottom of the questionnaire:

If your calculations are being powered by the New Engine, any changes you've recorded in the IFRS 16 Settings Change Questionnaire will automatically pull through to your reports.

Nomos One does not provide or purport to provide any accounting, financial, tax, legal or any professional advice, nor does Nomos One purport to offer a financial product or service. Nomos One is not responsible or liable for any claim, loss, damage, costs or expenses resulting from your use of or reliance on these resource materials. It is your responsibility to obtain accounting, financial, legal and taxation advice to ensure your use of the Nomos One system meets your individual requirements.