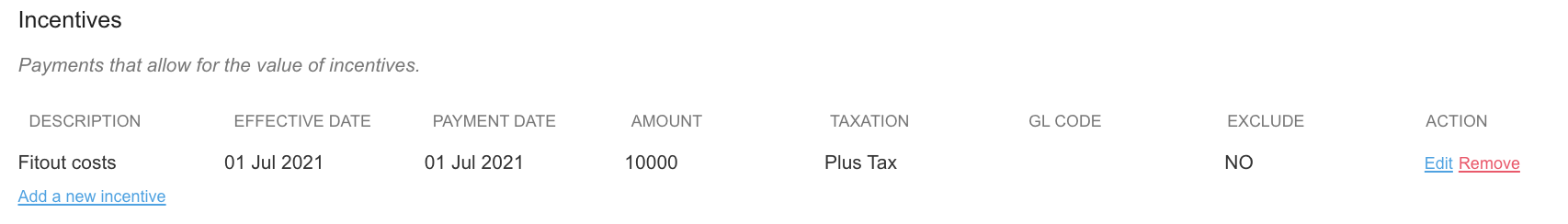

Using the Incentives feature in the IFRS Components section of the Rent & Payment page, you can capture payments - such as fit out contributions - made from the Lessor to the Lessee. In this article, we're breaking down exactly how the IFRS 16 Reporting suite processes incentives and reflects these payments in your Reports.

How does Nomos One account for Incentives?

When accounting for Incentives, we generate a two staged approach. Check out how this functions below.

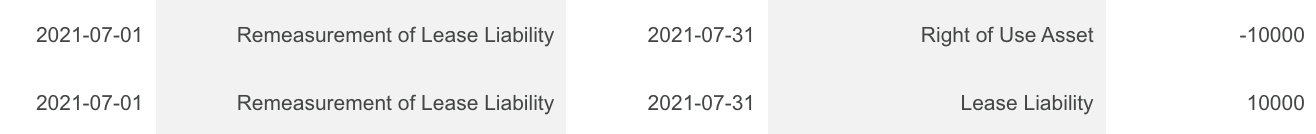

Stage One: Recognising the effective date of the Incentive

The first step we take is to recognise the Incentive being effective within the payment series. The Journal for this in the system is:

Please note: If the Effective Date of the transaction is before Commencement, this is incorporated in the Commencement balance calculation, so you won't see a Remeasurement entry.

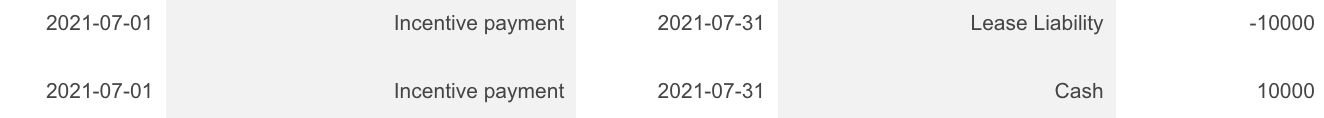

Stage Two: Recognising the payment of the Incentive

The second step is to recognise the payment of the Incentive and remove it from the payment series as once it has been paid it will no longer be incorporated into the Lease Liability calculation. As the first step has taken place, the Journal is:

Together, these two journal entries have a net impact of DR Cash and CR right of use asset to recognise the receiving of cash by the lessee and the reduction in the right of use asset value of the lease.

Nomos One does not provide or purport to provide any accounting, financial, tax, legal or any professional advice, nor does Nomos One purport to offer a financial product or service. Nomos One is not responsible or liable for any claim, loss, damage, costs or expenses resulting from your use of or reliance on these resource materials. It is your responsibility to obtain accounting, financial, legal and taxation advice to ensure your use of the Nomos One system meets your individual requirements.