If you need to extend the term of an Exempt Agreement (Short Term or Low Value under IFRS 16), there are some steps you'll need to follow to ensure that the expenses pull through to your Journals for the extended period.

How to Extend an Exempt Agreement

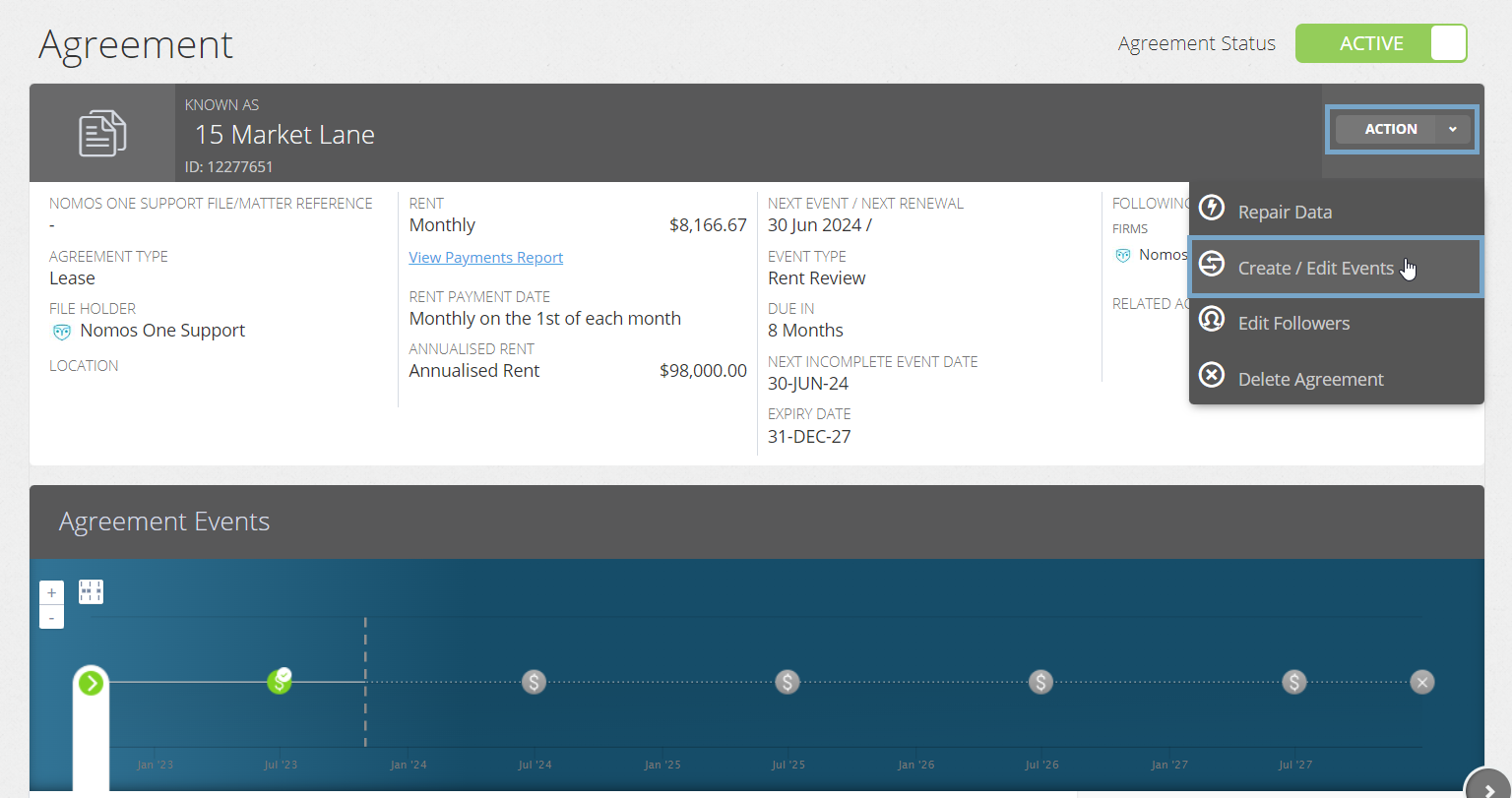

- Navigate to the Exempt Agreement

- Click Action > Create / Edit Events

- This will take you to the Events page of the Agreement Wizard where you can add in a Variation Event

- Using the calendar tool or text field, add in a Variation Event for the date you agreed to add a new Renewal or extend the length of a term in your Agreement. This Variation Event must be scheduled at least 1 day before the expiry of your existing term. Remember to click Add

Why does the Variation Event have to be at least 1 day before the expiry of the existing term?

In Nomos One, a Renewal or extension must be processed at least one (1) day before the expiry of the existing term, otherwise the Agreement would have logically expired in Nomos One when the change is processed - and you can't renew or extend an expired Agreement.

- While on the Events page, navigate up to the Initial Term / Renewals Section, and click Edit

Depending on which method you've chosen to extend your Agreement, follow either step 5A for adding a new Renewal, or step 5B for extending the length of existing term. After following step 5A or 5B, then go to step 6.

5A. If you're adding in a new Renewal, simply click the 'Add Renewal' button and adjust the term length as required for your new option

E.g. An option to Renew for 1 year has been agreed

5B. If you're needing to extend the length of an existing term in your Agreement, you're required to process this extension as a Renewal term for the length of the extension. Simply click the 'Add Renewal' button and adjust the length of the term to match the extension period contracted for

E.g. An extension of 3 years has been agreed, so a renewal term is added in for 3 years' duration

We understand that your extension is not actually a ‘Renewal’, however, due to a current system limitation, we require you to process any extensions this way to ensure your IFRS 16 Reports correctly factor in any increases in term length that happened throughout the life of your Agreement. Our Developers are working hard to resolve this issue and the workflow for processing extensions. We kindly ask that you follow this workaround until we notify you that this has been resolved.

- Once you've added in your Variation and Renewal or extension, click Done at the top of the Agreement Wizard to return to the Agreement Timeline

- On the Agreement Timeline, click on the Variation Event icon and then click Start Event

- At Step 2, simply click 'No additional variations', then click Next to continue

Currently, Rent Reviews and most Variations can't be actioned on Exempt Agreements as this results in an incorrect Journal entry: ‘Removal of Rent Payable’. For assistance with any rent changes and Variations, please contact our Support Team.

- Upload any supporting documentation, or select No Documentation, then click Next

- Confirm the data change date of the Variation Event. This should be the same as the Event Date. If these don't match, click Edit to adjust before clicking Complete

- Now your Variation Event is complete, navigate to the Agreement Header and click Action > Repair Data

- Go to the Initial IFRS 16 Questionnaire on the Settings page and and toggle the Exemption question from Yes to No

- Go to the Number of Renewals to factor into IFRS 16 Calculations, and select the new option that corresponds with the extended term you've added

- Toggle the Exemption question back to Yes

- Click Done at the top or bottom of the Agreement Wizard to return to the Agreement Overview page

Go and run your Journals! You should now see the expenses for the extended period pull through to your Journals.

Nomos One does not provide or purport to provide any accounting, financial, tax, legal or any professional advice, nor does Nomos One purport to offer a financial product or service. Nomos One is not responsible or liable for any claim, loss, damage, costs or expenses resulting from your use of or reliance on these resource materials. It is your responsibility to obtain accounting, financial, legal and taxation advice to ensure your use of the Nomos One system meets your individual requirements.